SPM nickel offers a cost-effective alternative to LME nickel, with prices often lower due to regional supply dynamics and fewer trading fees. Unlike LME nickel, which is traded on a global commodities exchange providing high liquidity and price transparency, SPM nickel typically involves direct transactions that can reduce market volatility exposure. Companies seeking flexible contract terms and quicker delivery times may prefer SPM nickel over the standardized, exchange-traded LME nickel contracts.

Table of Comparison

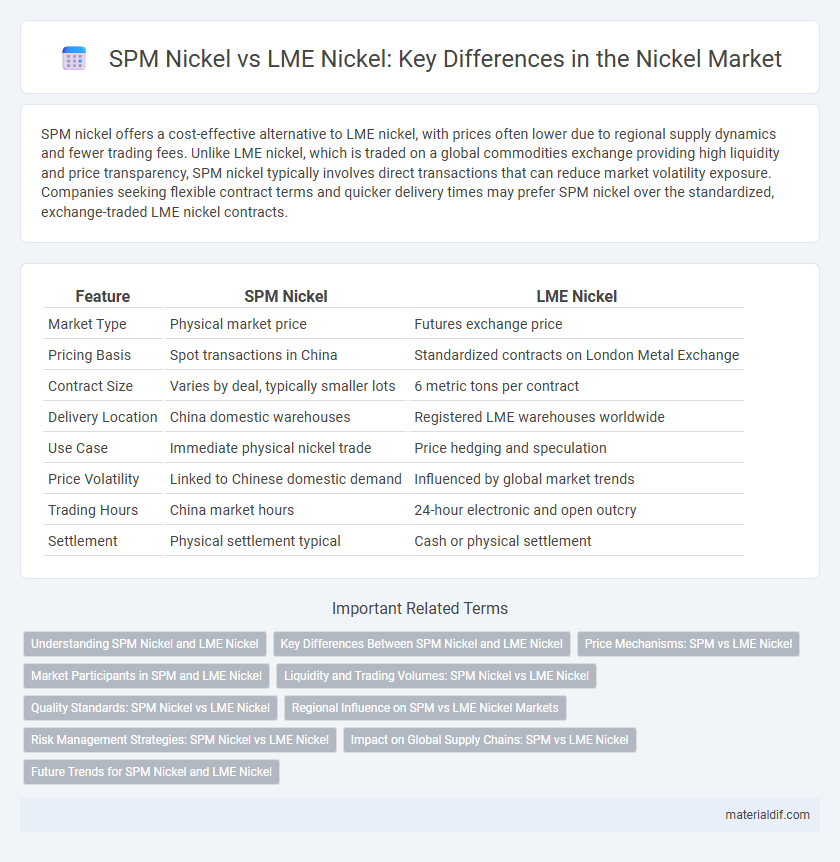

| Feature | SPM Nickel | LME Nickel |

|---|---|---|

| Market Type | Physical market price | Futures exchange price |

| Pricing Basis | Spot transactions in China | Standardized contracts on London Metal Exchange |

| Contract Size | Varies by deal, typically smaller lots | 6 metric tons per contract |

| Delivery Location | China domestic warehouses | Registered LME warehouses worldwide |

| Use Case | Immediate physical nickel trade | Price hedging and speculation |

| Price Volatility | Linked to Chinese domestic demand | Influenced by global market trends |

| Trading Hours | China market hours | 24-hour electronic and open outcry |

| Settlement | Physical settlement typical | Cash or physical settlement |

Understanding SPM Nickel and LME Nickel

SPM nickel refers to the price of nickel traded on the Shanghai Futures Exchange (SHFE), reflecting China's domestic market dynamics and demand. LME nickel is the benchmark price set by the London Metal Exchange, representing global market trends and international supply factors. Understanding the differences between SPM and LME nickel prices is crucial for investors and manufacturers assessing regional production, consumption patterns, and geopolitical influences.

Key Differences Between SPM Nickel and LME Nickel

SPM nickel prices are determined in the Singapore Precious Metals Exchange, reflecting regional supply-demand dynamics in Asia, whereas LME nickel prices are established on the London Metal Exchange, serving as a global benchmark. SPM nickel contracts often emphasize physical delivery and local Asian market requirements, while LME nickel features standardized futures contracts with global liquidity and risk management tools. Variations in contract specifications, such as grading, delivery points, and trading hours, create distinct trading environments for SPM and LME nickel participants.

Price Mechanisms: SPM vs LME Nickel

SPM nickel prices are determined through direct negotiation between producers and consumers, reflecting regional supply-demand dynamics primarily in Southeast Asia. LME nickel prices, on the other hand, are established via open outcry and electronic trading on the London Metal Exchange, serving as a global benchmark influenced by worldwide market sentiment and inventory levels. The SPM mechanism offers more flexibility and immediate settlement, while LME prices provide transparent, globally recognized price discovery with standardized contracts.

Market Participants in SPM and LME Nickel

SPM nickel primarily attracts Asian market participants, including Chinese stainless steel producers and regional traders seeking localized pricing benchmarks, while LME nickel engages a broader global audience such as multinational mining companies, global stainless steel manufacturers, and speculative investors. The Shanghai Futures Exchange (SHFE) hosts the SPM nickel contracts, catering to domestic demand with physically delivered contracts influencing Chinese supply chains, whereas the London Metal Exchange (LME) operates a widely recognized global benchmark with cash-settled and prompt delivery options, facilitating price discovery and risk management on an international scale. Market liquidity on LME nickel is deeper, attracting high-frequency trading and financial institutions, while SPM nickel focuses on physical delivery and inventory management within China's strategic metal reserves.

Liquidity and Trading Volumes: SPM Nickel vs LME Nickel

SPM nickel often exhibits lower liquidity and narrower trading volumes compared to LME nickel, which benefits from a broader global participant base and established market infrastructure. The London Metal Exchange (LME) nickel contracts typically surpass SPM in daily turnover, enhancing price discovery and market depth. This liquidity disparity influences hedging efficiency and the execution of large trades within both markets.

Quality Standards: SPM Nickel vs LME Nickel

SPM Nickel typically adheres to stringent quality standards defined by regional specifications, often emphasizing higher purity levels and consistent chemical composition tailored for specialized industries. LME Nickel, traded on the London Metal Exchange, follows internationally recognized benchmarks for purity and grade, ensuring standardization that facilitates global trading and contract performance. The distinction in quality standards influences buyer preferences, with SPM Nickel favored for applications requiring precise metallurgical properties, while LME Nickel serves broader industrial uses due to its uniform market specifications.

Regional Influence on SPM vs LME Nickel Markets

SPM nickel prices primarily reflect supply and demand dynamics within the Asia-Pacific region, heavily influenced by China, the world's largest nickel consumer and producer. LME nickel, traded globally on the London Metal Exchange, represents a broader market price affected by international trade flows and global inventory levels. Regional policies, production costs, and logistical factors in Asia often cause SPM nickel prices to diverge from LME benchmarks, underscoring the localized impact on SPM versus the global scope of LME nickel markets.

Risk Management Strategies: SPM Nickel vs LME Nickel

SPM nickel, traded over-the-counter with regional price influence, demands risk management strategies emphasizing localized market factors and counterparty credit risk, unlike LME nickel which relies on exchange-traded contracts with standardized terms and robust clearinghouse guarantees. Hedging in LME nickel benefits from standardized lot sizes and transparent price discovery, enabling tighter risk control and liquidity management, whereas SPM nickel requires customized contracts and vigilant credit risk monitoring due to less formalized trading mechanisms. Firms managing SPM nickel exposure often implement bespoke credit assessments and bilateral collateral agreements, contrasting with the margining systems and daily mark-to-market settlement that dominate LME nickel risk management.

Impact on Global Supply Chains: SPM vs LME Nickel

SPM nickel, produced primarily in the Philippines through laterite mining and HPAL processing, offers a more accessible supply source influencing global nickel availability, especially for stainless steel and battery manufacturers. LME nickel, traded on the London Metal Exchange, provides a transparent, standardized benchmark price that impacts global contract negotiations and risk management strategies for supply chains. The divergence between SPM nickel's physical supply characteristics and LME nickel's financial instrument status creates complexities in price discovery and inventory logistics, shaping procurement decisions across international markets.

Future Trends for SPM Nickel and LME Nickel

Future trends for SPM nickel focus on increasing demand from Southeast Asia's growing stainless steel and battery industries, driving regional price premiums and tighter supply chains. LME nickel prices are influenced by global market dynamics, including EV battery demand, metallurgical innovations, and geopolitical factors, resulting in increased volatility and potential for long-term upward price trends. Emerging sustainability regulations and supply diversification efforts are expected to impact both SPM and LME nickel markets, promoting transparency and traceability in nickel sourcing.

SPM nickel vs LME nickel Infographic

materialdif.com

materialdif.com