Platinum Group Metals (PGMs) consist of six elements including platinum, palladium, rhodium, ruthenium, iridium, and osmium, known for their exceptional catalytic properties and industrial applications. Precious metals encompass a broader category including gold, silver, and PGMs, valued primarily for their rarity and investment potential. While all PGMs are precious metals, their distinct chemical and physical properties make PGMs especially critical in automotive catalytic converters and electronics.

Table of Comparison

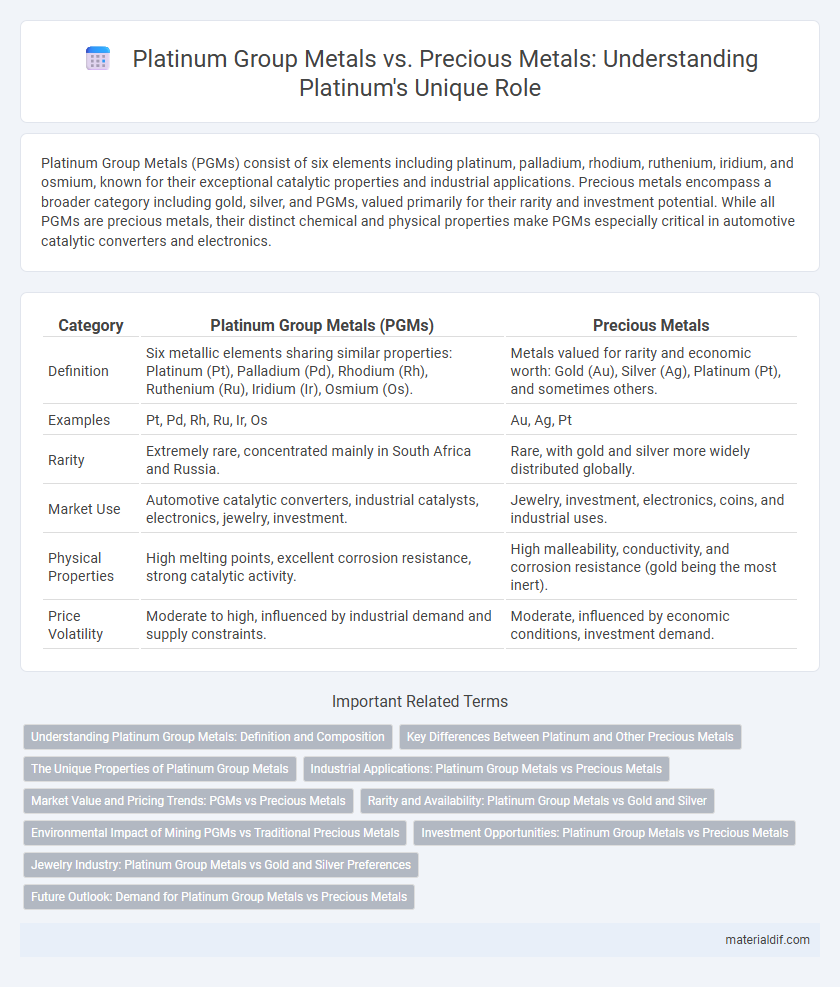

| Category | Platinum Group Metals (PGMs) | Precious Metals |

|---|---|---|

| Definition | Six metallic elements sharing similar properties: Platinum (Pt), Palladium (Pd), Rhodium (Rh), Ruthenium (Ru), Iridium (Ir), Osmium (Os). | Metals valued for rarity and economic worth: Gold (Au), Silver (Ag), Platinum (Pt), and sometimes others. |

| Examples | Pt, Pd, Rh, Ru, Ir, Os | Au, Ag, Pt |

| Rarity | Extremely rare, concentrated mainly in South Africa and Russia. | Rare, with gold and silver more widely distributed globally. |

| Market Use | Automotive catalytic converters, industrial catalysts, electronics, jewelry, investment. | Jewelry, investment, electronics, coins, and industrial uses. |

| Physical Properties | High melting points, excellent corrosion resistance, strong catalytic activity. | High malleability, conductivity, and corrosion resistance (gold being the most inert). |

| Price Volatility | Moderate to high, influenced by industrial demand and supply constraints. | Moderate, influenced by economic conditions, investment demand. |

Understanding Platinum Group Metals: Definition and Composition

Platinum Group Metals (PGMs) consist of six metallic elements: platinum, palladium, rhodium, ruthenium, iridium, and osmium, all known for their exceptional catalytic properties and resistance to corrosion. These metals are often categorized separately from precious metals like gold and silver due to their unique chemical characteristics and industrial applications. Understanding the composition of PGMs is crucial for industries such as automotive, electronics, and jewelry, where platinum's catalytic efficiency and durability play a vital role.

Key Differences Between Platinum and Other Precious Metals

Platinum, a member of the Platinum Group Metals (PGMs), exhibits distinct properties such as higher density, greater resistance to corrosion, and exceptional catalytic performance compared to other precious metals like gold and silver. Unlike gold and silver, which are primarily valued for their malleability and conductivity, platinum's rarity and stability at high temperatures make it essential in industrial applications like catalytic converters and fuel cells. The unique chemical behavior and scarcity of PGMs position platinum as a critical metal with both investment and technological significance, differentiating it fundamentally from traditional precious metals.

The Unique Properties of Platinum Group Metals

Platinum Group Metals (PGMs) including platinum, palladium, rhodium, ruthenium, iridium, and osmium exhibit exceptional catalytic properties and high resistance to corrosion that distinguish them from other precious metals like gold and silver. Their unique ability to withstand extreme temperatures without degrading makes PGMs indispensable in industrial applications such as automotive catalytic converters and chemical processing. The rarity and durability of PGMs contribute to their critical role in both technological advancements and investment portfolios.

Industrial Applications: Platinum Group Metals vs Precious Metals

Platinum Group Metals (PGMs), including platinum, palladium, rhodium, and iridium, exhibit superior catalytic properties essential for industrial applications such as automotive catalytic converters and hydrogen fuel cells. Precious metals like gold and silver are primarily valued for their corrosion resistance and electrical conductivity, making them less favored than PGMs in chemical processing and catalytic technologies. The unique combination of durability, high melting points, and catalytic efficiency positions PGMs as critical materials in refining, electronics, and clean energy industries.

Market Value and Pricing Trends: PGMs vs Precious Metals

Platinum Group Metals (PGMs) including platinum, palladium, and rhodium exhibit distinct market value and pricing trends compared to traditional precious metals like gold and silver, driven largely by their critical industrial applications and supply constraints. PGMs often experience higher price volatility due to their specialized uses in automotive catalytic converters and hydrogen fuel cells, contrasting with gold's role as a stable financial asset and silver's dual industrial and monetary demand. Market analysis reveals that while gold maintains consistent value retention, the pricing trends of PGMs are more sensitive to shifts in automotive industry regulations and technological advancements, leading to significant fluctuations in their market value.

Rarity and Availability: Platinum Group Metals vs Gold and Silver

Platinum Group Metals (PGMs), including platinum, palladium, and rhodium, exhibit significantly higher rarity compared to traditional precious metals like gold and silver, with platinum being about 30 times rarer than gold. PGMs are primarily sourced from limited regions such as South Africa and Russia, resulting in constrained availability and greater price volatility. Gold and silver enjoy broader geographic distribution and more abundant reserves, contributing to their greater accessibility and relatively stable supply chains.

Environmental Impact of Mining PGMs vs Traditional Precious Metals

Platinum Group Metals (PGMs) mining generally results in lower environmental degradation compared to traditional precious metals like gold and silver due to more efficient extraction processes and lesser volume of ore required. PGMs production emits fewer greenhouse gases and generates less toxic waste, reducing soil and water contamination risks. Innovations in PGM recycling further mitigate mining impacts, making them a more sustainable choice within the precious metals sector.

Investment Opportunities: Platinum Group Metals vs Precious Metals

Platinum Group Metals (PGMs), including platinum, palladium, rhodium, ruthenium, iridium, and osmium, offer unique investment opportunities compared to traditional precious metals like gold and silver due to their critical industrial applications in automotive catalytic converters, electronics, and hydrogen fuel cells. PGMs typically exhibit lower price volatility and stronger correlations with industrial demand, making them attractive for investors seeking diversification beyond conventional safe-haven assets. The growing adoption of green technologies and tightening emissions regulations are expected to drive long-term demand and price appreciation for PGMs, positioning them as strategic metals with significant investment potential relative to gold and silver.

Jewelry Industry: Platinum Group Metals vs Gold and Silver Preferences

Platinum Group Metals (PGMs), including platinum, palladium, and rhodium, offer superior durability and hypoallergenic properties, making them highly valued in the jewelry industry compared to traditional precious metals like gold and silver. Gold remains favored for its classic appeal and versatility in various alloys, while silver is prized for affordability but lacks the corrosion resistance intrinsic to PGMs. Consumer preferences increasingly shift towards platinum for premium jewelry pieces due to its rarity and long-lasting luster, influencing market demand and pricing within the luxury segment.

Future Outlook: Demand for Platinum Group Metals vs Precious Metals

Demand for Platinum Group Metals (PGMs) is projected to grow substantially due to their critical roles in automotive catalytic converters, hydrogen fuel cells, and renewable energy technologies. Precious metals like gold and silver are expected to maintain steady demand driven primarily by investment and jewelry sectors. The transition to green energy and stricter emission regulations will likely boost PGM consumption, positioning them as key players in future industrial applications.

Platinum Group Metals vs Precious Metals Infographic

materialdif.com

materialdif.com