Fine gold, characterized by its high purity of 99.9% or more, is prized for its intrinsic value and malleability, making it ideal for investment bars and jewelry. Coin gold, with a lower purity typically around 90%, combines durability and historical significance, appealing to collectors and investors seeking liquidity and legal tender status. Choosing between fine gold and coin gold depends on priorities such as purity, wear resistance, and collectible appeal.

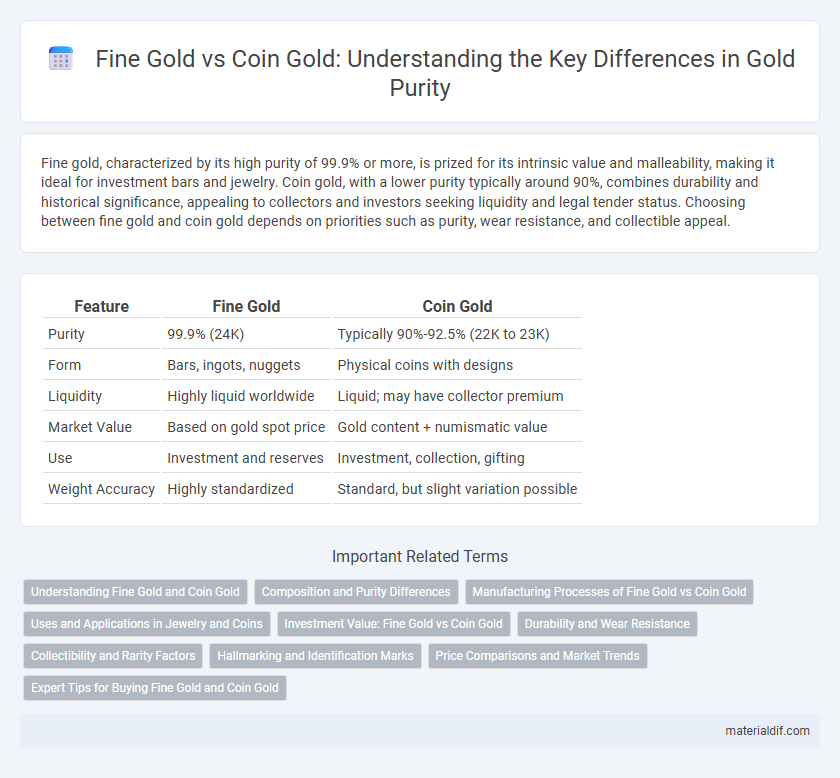

Table of Comparison

| Feature | Fine Gold | Coin Gold |

|---|---|---|

| Purity | 99.9% (24K) | Typically 90%-92.5% (22K to 23K) |

| Form | Bars, ingots, nuggets | Physical coins with designs |

| Liquidity | Highly liquid worldwide | Liquid; may have collector premium |

| Market Value | Based on gold spot price | Gold content + numismatic value |

| Use | Investment and reserves | Investment, collection, gifting |

| Weight Accuracy | Highly standardized | Standard, but slight variation possible |

Understanding Fine Gold and Coin Gold

Fine gold refers to pure gold with a high level of purity, typically 99.9% or higher, making it ideal for investment and industrial use due to its consistent quality and value. Coin gold, on the other hand, is gold minted into coins with a lower purity often around 90%, including alloys to enhance durability for circulation and collectible appeal. Understanding the distinction between fine gold and coin gold is crucial for investors and collectors in assessing value, liquidity, and intended usage.

Composition and Purity Differences

Fine gold typically contains 99.9% pure gold, characterized by its nearly flawless composition ideal for investment and industrial use. Coin gold, composed of gold alloys such as 22-karat (91.67% gold) or 24-karat versions, incorporates metals like copper or silver to enhance durability and resistance to wear. Purity differences affect the gold's color, weight, and market value, with fine gold prized for purity and coin gold favored for practical applications in currency and collectibles.

Manufacturing Processes of Fine Gold vs Coin Gold

Fine gold undergoes a refining process to achieve a purity level of 99.9% or higher, involving techniques such as chemical treatment and electrolysis to remove impurities. Coin gold combines gold with other metals like copper or silver through alloying, which enhances durability and resistance to wear in manufacturing, typically through casting or stamping methods. These distinct processes result in fine gold bars prized for investment purity, while coin gold balances purity with physical strength for circulation and collectible value.

Uses and Applications in Jewelry and Coins

Fine gold, with a purity of 99.9% or higher, is preferred for intricate jewelry due to its malleability and rich yellow hue, making it ideal for high-quality, premium pieces. Coin gold typically contains slightly less purity, often around 90%, to enhance durability and resistance to wear, which is essential for circulating currency and collectible coins. Jewelry applications favor fine gold for its luster and hypoallergenic properties, while coin gold balances purity with hardness to ensure longevity in daily handling and storage.

Investment Value: Fine Gold vs Coin Gold

Fine gold, typically 99.9% pure, holds intrinsic value based solely on its weight and purity, making it a stable long-term investment resistant to market fluctuations. Coin gold, often minted with specific designs and limited editions, carries numismatic value that can exceed its gold content, appealing to collectors and potentially offering higher returns. Investors seeking liquidity and price stability may prefer fine gold bars or bullion, while those interested in diversification and potential premium gains might choose coin gold for its collectible advantages.

Durability and Wear Resistance

Fine gold, typically 99.9% pure, is softer and more prone to wear and scratches due to its high purity, making it less durable for everyday handling. Coin gold, an alloy often containing 90% gold mixed with metals like copper or silver, offers enhanced durability and greater wear resistance ideal for physical transactions and long-term storage. The increased hardness of coin gold allows it to maintain its shape and detail over time, outperforming fine gold in durability under regular use.

Collectibility and Rarity Factors

Fine gold, typically valued for its purity of 99.9% or higher, is favored in investment portfolios due to its consistent quality but generally lacks the unique design elements that enhance collectibility. Coin gold, often minted with historical and artistic significance, gains value from its rarity, limited mintage, and cultural importance, making it highly sought after by collectors. Collectibility and rarity factors elevate coin gold above fine gold, especially where numismatic value surpasses mere gold content.

Hallmarking and Identification Marks

Fine gold is typically marked with a hallmark indicating its purity, often 999 or 24 karats, signifying nearly pure gold content. Coin gold, such as historical gold coins, features identification marks including mint marks, year of issue, and denomination, which authenticate origin and value. Both hallmarking and identification marks are critical for verifying authenticity, purity, and legal status in gold trading and investment.

Price Comparisons and Market Trends

Fine gold, typically 24 karats with a purity of 99.9%, commands a higher price per gram due to its purity and demand in investment-grade bullion and jewelry; coin gold, often 22 karats or lower, includes collectible premiums that can fluctuate based on rarity and historical value. Market trends indicate that fine gold prices closely track the spot gold price affected by global economic factors, while coin gold prices are more volatile, influenced by numismatic interest and collector demand. Investors seeking liquidity favor fine gold for its stable pricing, whereas collectors might pay a premium on coin gold during market upswings driven by scarcity and uniqueness.

Expert Tips for Buying Fine Gold and Coin Gold

Fine gold, typically 24 karats with a purity of 99.9%, is favored for its intrinsic value and is ideal for investors seeking long-term wealth preservation. Coin gold, which usually contains 90-91.67% pure gold with added metals for durability, offers liquidity and collectible appeal, making it suitable for both investment and numismatic interest. Experts recommend verifying authenticity through certified grading services and considering market premiums and gold spot prices when purchasing fine or coin gold to maximize returns and minimize risk.

Fine Gold vs Coin Gold Infographic

materialdif.com

materialdif.com