Gold nuggets are natural, unrefined pieces of gold found in rivers and streams, prized for their unique shapes and rarity, while gold bullion refers to refined gold bars or ingots produced by mints or manufacturers, valued primarily for their purity and weight. Nuggets carry intrinsic fascination for collectors and investors looking for a more tangible connection to natural gold, whereas bullion is favored for its standardized value and ease of liquidity in the market. Choosing between gold nuggets and bullion depends on whether the priority lies in collectible appeal or investment ease.

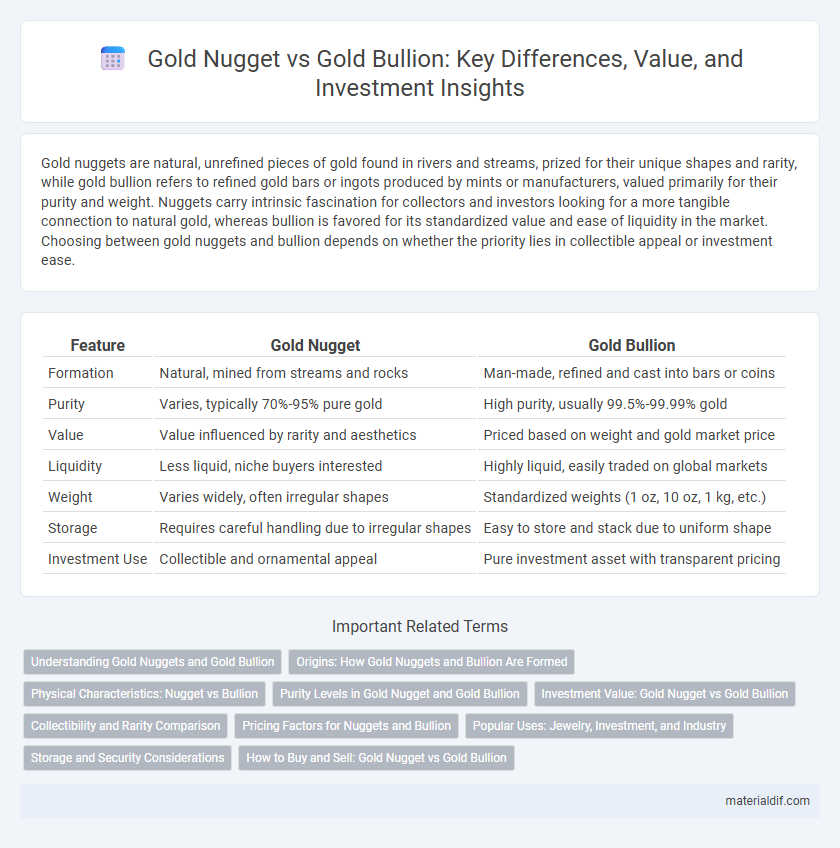

Table of Comparison

| Feature | Gold Nugget | Gold Bullion |

|---|---|---|

| Formation | Natural, mined from streams and rocks | Man-made, refined and cast into bars or coins |

| Purity | Varies, typically 70%-95% pure gold | High purity, usually 99.5%-99.99% gold |

| Value | Value influenced by rarity and aesthetics | Priced based on weight and gold market price |

| Liquidity | Less liquid, niche buyers interested | Highly liquid, easily traded on global markets |

| Weight | Varies widely, often irregular shapes | Standardized weights (1 oz, 10 oz, 1 kg, etc.) |

| Storage | Requires careful handling due to irregular shapes | Easy to store and stack due to uniform shape |

| Investment Use | Collectible and ornamental appeal | Pure investment asset with transparent pricing |

Understanding Gold Nuggets and Gold Bullion

Gold nuggets are naturally occurring pieces of native gold found in rivers and streams, valued for their unique shapes and rarity, often prized by collectors; gold bullion, in contrast, refers to refined gold bars or coins manufactured for investment, characterized by standardized purity and weight, typically 99.5% to 99.99% purity. Understanding gold nuggets requires knowledge of their geological formation and authenticity testing, while gold bullion is assessed primarily on purity, weight, and certification from mints or refineries. Both forms represent tangible assets in the gold market but serve different purposes: nuggets appeal to collectors and enthusiasts, whereas bullion is favored for liquidity and standardized investment security.

Origins: How Gold Nuggets and Bullion Are Formed

Gold nuggets are naturally occurring pieces of native gold formed through geological processes such as erosion, weathering, and sedimentation, often found in riverbeds and alluvial deposits. Gold bullion, in contrast, is refined gold that has been melted and cast into bars or ingots through industrial processes, ensuring purity and standard weight for investment and commercial purposes. The natural creation of nuggets involves mineral-rich environments and time, while bullion production relies on human extraction, refining, and minting techniques.

Physical Characteristics: Nugget vs Bullion

Gold nuggets exhibit irregular, naturally occurring shapes and textures, often with unique, rough surfaces that reflect their natural formation in placer deposits. Gold bullion, in contrast, is refined into standardized, smooth, and precisely shaped bars or coins with consistent dimensions and purity levels, designed for easy stacking, storage, and trading. The physical characteristics of nuggets emphasize natural beauty and rarity, whereas bullion focuses on uniformity and liquidity in the market.

Purity Levels in Gold Nugget and Gold Bullion

Gold nuggets typically exhibit natural purity levels ranging from 70% to 95%, containing varying amounts of other metals like silver and copper, while gold bullion is refined to a higher purity standard, often 99.5% to 99.99% pure. The natural alloy composition in gold nuggets affects their weight and value, whereas gold bullion's consistent purity is guaranteed by certified assays and hallmark stamps. Investors seeking maximum purity and market liquidity generally prefer gold bullion over gold nuggets, whose inherent impurities make them more prized for collectors and jewelry rather than precise investment metrics.

Investment Value: Gold Nugget vs Gold Bullion

Gold bullion offers consistent purity and standardized weight, making it highly liquid and preferred for investment portfolios seeking reliability and ease of trade. Gold nuggets, while unique and potentially carrying a premium due to their natural origin and rarity, often have variable purity that complicates valuation and resale. Investors prioritize gold bullion for stable market demand and transparent pricing, whereas gold nuggets appeal to collectors or niche investors valuing rarity over standardized investment metrics.

Collectibility and Rarity Comparison

Gold nuggets exhibit natural, irregular shapes and unique textures, making them highly sought-after by collectors due to their rarity and distinctiveness. Gold bullion, often produced in standardized bars or coins, offers purity and uniformity but lacks the organic and one-of-a-kind appeal of nuggets. Collectibility is driven by the scarcity and natural beauty of nuggets, whereas bullion's value is primarily associated with weight and market gold price.

Pricing Factors for Nuggets and Bullion

Gold nugget prices often exceed the spot price of gold due to their rarity, unique natural shapes, and collector demand, whereas gold bullion pricing closely reflects the spot market value for purity and weight. Nuggets may carry a premium influenced by size, origin, and surface characteristics, while bullion prices are driven by global gold market fluctuations and refinery costs. Market liquidity and ease of resale also impact bullion's pricing stability compared to the more volatile premium on nuggets.

Popular Uses: Jewelry, Investment, and Industry

Gold nuggets are highly valued in jewelry for their natural, unique shapes and are often viewed as collectible items, while gold bullion, typically in bars or coins, is primarily used for investment due to its standardized purity and weight. In the jewelry industry, gold bullion is melted down and alloyed to create consistent, high-quality pieces, whereas nuggets rarely undergo extensive processing. Industrial applications favor gold bullion for manufacturing electronics and medical devices because of its reliable composition and malleability.

Storage and Security Considerations

Gold nuggets require specialized storage solutions to preserve their natural form and prevent damage, often necessitating custom display cases or secure vault compartments. Gold bullion, available in standardized bars or coins, benefits from widely accepted secure storage options like accredited vault facilities and safety deposit boxes, offering insured protection and easier inventory management. Security protocols for both forms emphasize the importance of controlled access, climate control to prevent tarnishing (mainly for nuggets), and comprehensive insurance coverage to mitigate theft or loss risks.

How to Buy and Sell: Gold Nugget vs Gold Bullion

Gold nuggets offer a unique investment experience by combining rarity and natural form, often purchased from specialized dealers or prospecting sites, while gold bullion--available as bars or coins--is more liquid and traded through banks, brokers, and online platforms. Selling gold nuggets typically requires evaluation by experts due to their variable purity and size, whereas gold bullion's value is straightforwardly determined by weight and market price, allowing quick liquidation. Investors should verify authenticity and market demand in both cases to optimize buying and selling outcomes.

Gold Nugget vs Gold Bullion Infographic

materialdif.com

materialdif.com